Metadata

- Author: Packy McCormick

- Full Title: Better Tools, Bigger Companies

- URL: https://www.notboring.co/p/better-tools-bigger-companies

Highlights

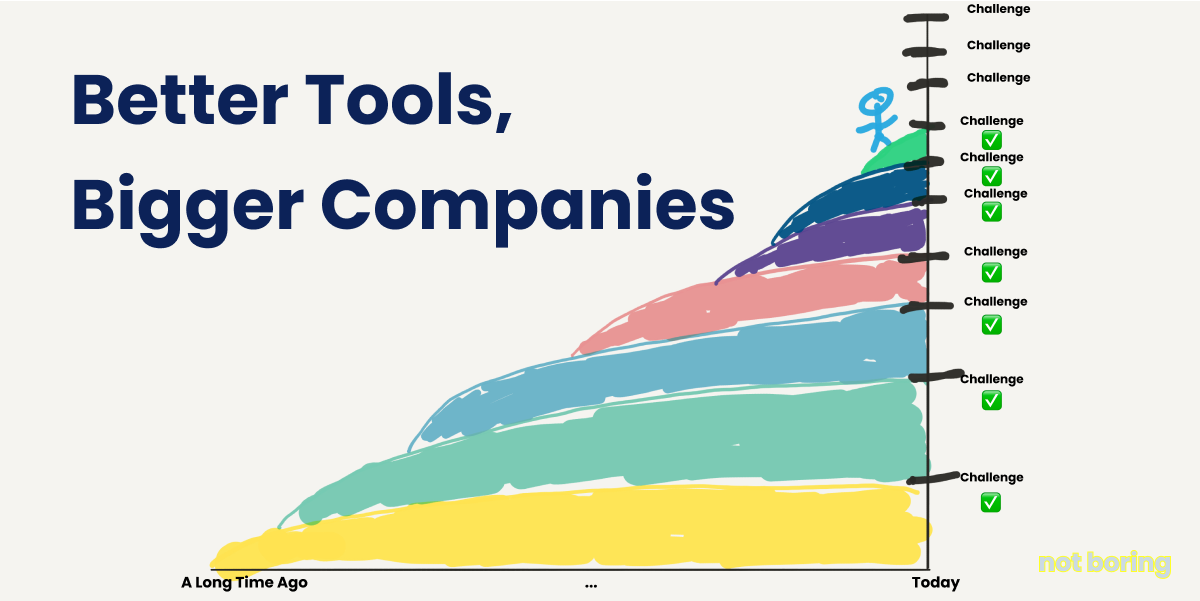

- I’m doing it because I think we’re in one of those periods when the next generation of really big companies is going to be born, that this generation’s winners will be bigger than previous generations’, and that many of them will be Techno-Industrials. I want to study the specific companies to understand the category more generally. (View Highlight)

- Tech is going to get much bigger. I don’t want to brag, but I’ve been yelling this through the depths of the bear market and I’ll yell it through the next one. I may be dumb, but I’m consistent. And it looks like, for now at least, I’m right. (View Highlight)

- What’s happening? Wasn’t tech falling apart just a few months ago? Aren’t rates still high? (View Highlight)

- Yesterday’s funding announcements included AI, of course (Scale raised 125 million, and French company [H raised a 150 million), identity (Footprint raised 100 million), and defense ([Anduril is rumored to be raising 1.5 billion](https://www.theinformation.com/articles/anduril-seeks-12-5-billion-valuation-after-doubling-revenue?utm_campaign=article_email&utm_content=article-12861&utm_medium=email&utm_source=sg&rc=nfmj4u), drone company [Neros](https://www.neros.tech/) raised 10.9 million the day before). To top it all off, I turned on Invest Like the Best and listened to a great conversation with Skyryse CEO Mark Groden about making personal aviation safe and accessible. We might actually get our flying cars! (View Highlight)

- The rumors of venture capital’s demise have been greatly exaggerated. The most successful tech companies built today will be bigger than any that have come before, for the simple reason that they have better tools to build with. My bet is that those tools have gotten good enough that they can mount serious attacks on the biggest sectors of the economy and reshape the physical world. (View Highlight)

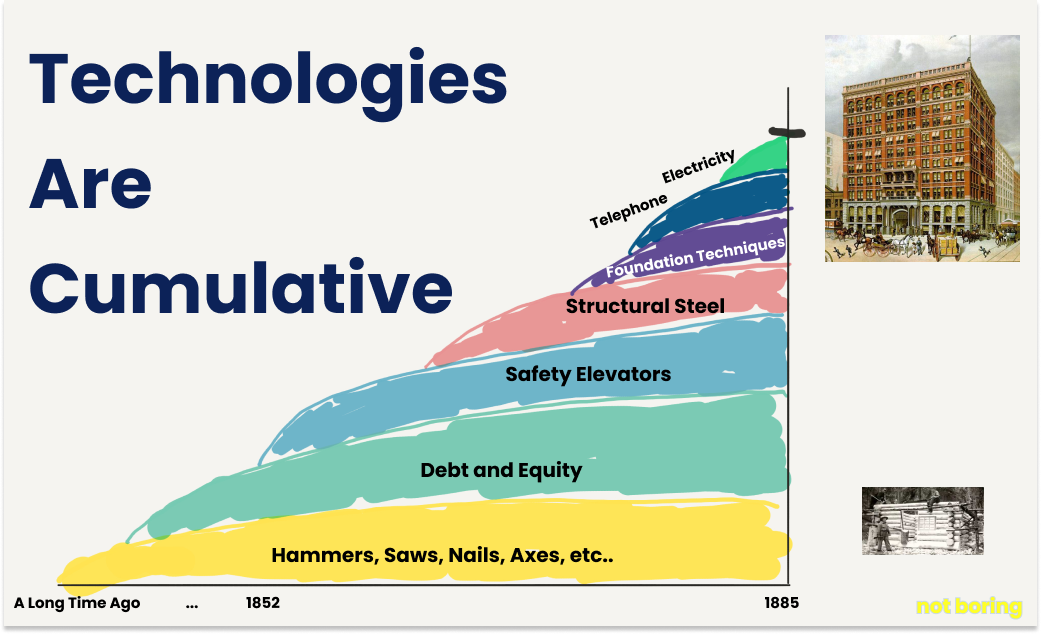

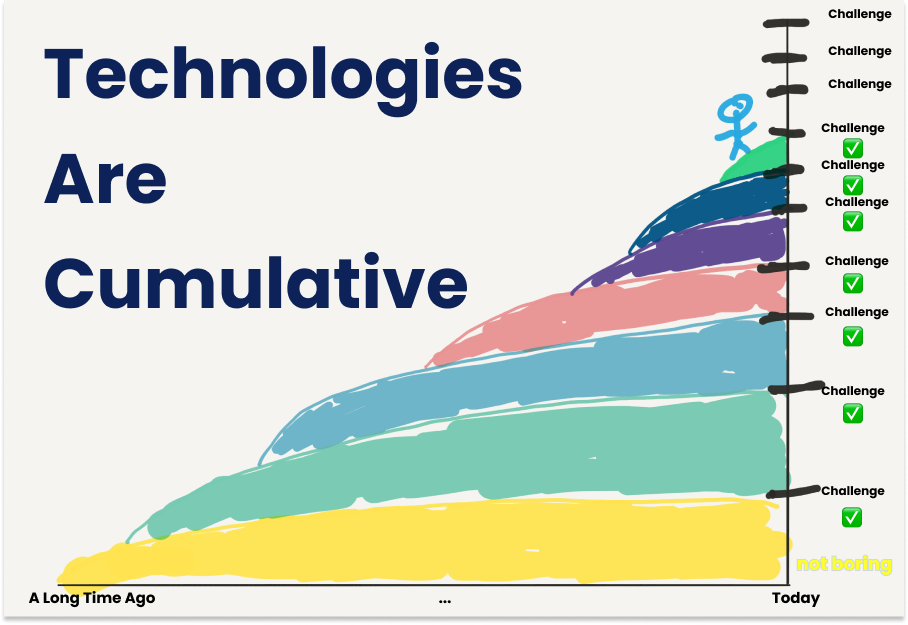

- But I think you get the point: technologies are cumulative. (View Highlight)

(View Highlight)

(View Highlight) (View Highlight)

(View Highlight)- The skyscraper is just one example of a much broader pattern. Across every domain, from transportation to finance to energy to healthcare, new tools make better solutions possible. (View Highlight)

- Tags: favorite

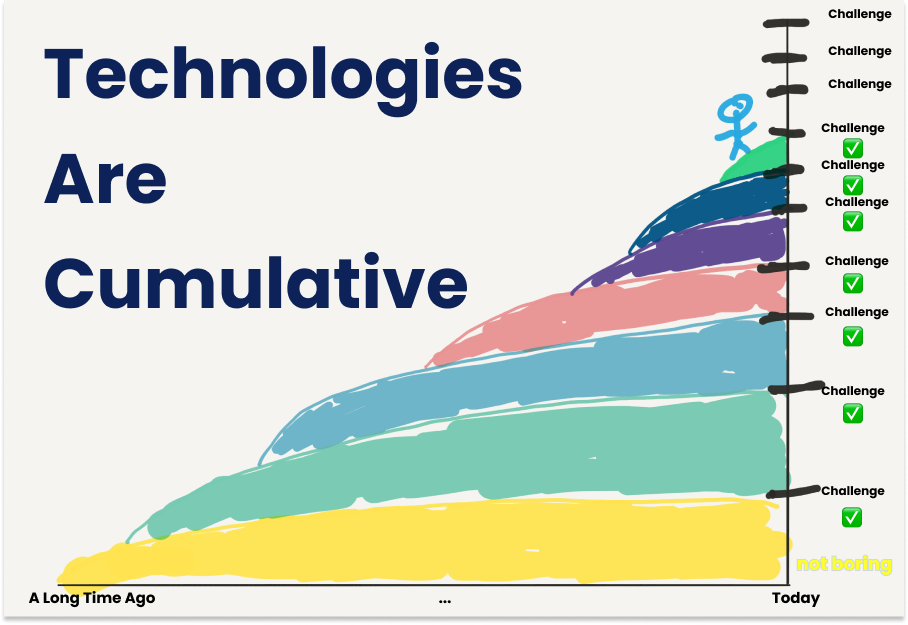

- The more and better tools, the bigger and harder challenges builders can address with them. (View Highlight)

- I think about it like this. We know most of the challenges facing humanity and the opportunities that would make an impact, financial and social, if they were possible to build. (View Highlight)

- Tags: favorite

(View Highlight)

(View Highlight) (View Highlight)

(View Highlight)- But that drawing isn’t quite right. The ladder is more exponential than that. The more tools we have, the faster we can build new tools, and on and on. (View Highlight)

- Whatever problems face us, we have more tools in the toolbox, more building blocks to solve it. And because we have digital technologies, it allows us to search the space much faster than we could before. And hence, we can come up with solutions faster than we could before. (View Highlight)

- Which is all a long way of saying: however bullish you are on technology companies, you’re not bullish enough. (View Highlight)

- Most of the value created in tech over the past half-century has come from applying software tools to information industry challenges. Microsoft brought work onto the computer. Facebook connected people across the globe. Google organized the world’s information. Apple did this… (View Highlight)

- Century-old incumbents have remained comfortably atop these industries because attempts to innovate with software have been sustaining innovations. Incumbents have adopted the good ones to improve their bottom lines, but software alone hasn’t reshaped these industries. (View Highlight)

- You need to introduce an entirely new paradigm, which requires reaching much higher on the cumulative technology ladder than previous solutions. Because while the accumulation of tools is continuous, there are discrete periods in history when those tools have gotten better enough to make new solutions possible. (View Highlight)

- think we’re in one of those periods. Instead of designing slightly better versions of old products – not better enough to displace incumbents – or fixing inefficiencies with software, entrepreneurs are designing radically better vertically integrated systems from the ground up with cutting edge hardware and software. (View Highlight)

- “Deep tech” is a nebulous term that’s used to mean doing something with the most advanced technology at our disposal, particularly if that technology touches the physical world. It’s confused with hard tech and frontier tech, because, well, it’s confusing. (View Highlight)

- Part of the confusion around the term comes from the fact that two categories of companies get lumped into deep tech: Toolmakers and Techno-Industrials. (View Highlight)

- Toolmakers operate at the very bleeding edge, coming up with brand new science and technology, with a primary focus on the science and technology themselves. (View Highlight)

- Techno-Industrials start with the challenge they want to solve, and use every tool at their disposal, including some at the cutting edge and even some that they have to create themselves, to solve that challenge. (View Highlight)

- When I first wrote about them, I defined Techno-Industrials as companies that “use technology to build atoms-based products with structurally superior unit economics with the ultimate goal of winning on cost in large existing markets, or expanding or creating new markets where there is pent-up demand.” (View Highlight)

- Toolmakers are closer to what I’d categorize as actual deep tech. They are solving deeply technical problems in order to give humanity fundamentally new capabilities. They’re often the ones pushing the exponential curves. A company developing a new type of semiconductor, new materials, or more efficient solar cells might fit into this category. (View Highlight)

- Techno-Industrials, on the other hand, are the ones riding exponential curves. They’re integrators as much as they are innovators, incorporating a number of technologies that hit just the right spot on their curves to be practically and economically useful in solving a particular challenge (new or old) in a better way. (View Highlight)

- Earth AI uses AI and drilling rigs to find previously overlooked critical minerals. (View Highlight)

- When Anduril launched in 2017, it was famously met with a ton of skepticism. Some of it came from the fact that investors found defense distasteful, but a lot of it came from a lack of knowledge about the defense industry. (View Highlight)

- Over the past seven years, Anduril both proved that it was possible to build a big business in defense and educated the market on how the defense industry works. If you ask a random VC what “cost-plus” means today, most will actually know what you’re talking about! (View Highlight)

- As Anduril co-founder Trae Stephens wrote in Venture Capital’s Space for Sheep:

Today, Anduril is valued at more than 200 million in venture investment flowed into defense technology; last year, that figure topped $6 billion. Investors see our success as proof the defense industry can generate serious returns, and now they’re hoping to get a piece of the next Anduril. (View Highlight)

- That, Trae believes, is the wrong lesson to take from Anduril. “In all likelihood,” he writes, “another defense tech company operating at Anduril’s scale won’t come out of this hype cycle.” The right lesson to take from Anduril is that it’s possible to build very big businesses by applying a suite of cutting edge tools and processes to the right bottlenecks in large, seemingly impenetrable industries. (View Highlight)

- And thanks to the power law, there will be one really big winner in each industry:

Defense, like all technology sectors, is ruled by the power law: a single, prime mover will claim the vast majority of profits even after the sector has reached maturity. The company that carves out a new investment category usually stays on top. (View Highlight)

- There are a few big reasons that I think now is such a fertile time to build $100 billion+ Techno-Industrials:

- Tools. There are simply more tools at builders’ disposal – AI, traditional software, improving hardware, programmable biology, cheaper energy, robots, and more – that they can combine into vertically integrated companies.

- Cracks. The old system is showing cracks. The grid is struggling. Planes are falling apart. Carbon emissions have to go. Healthcare costs are through the roof. Metals discoveries are declining. Supply chains are breaking down. America’s industrial base has atrophied. The biggest systems in the world need to be rebuilt.

- Enormous Markets. Most of the largest companies by revenue are not tech companies, and most of the world’s GDP is outside of tech: in energy, healthcare, labor, real estate, and manufacturing. These are multi-trillion dollar markets.

- Pent-Up Opportunity. Entrepreneurs and investors have largely ignored these categories in favor of software, which means there are more opportunities left to build power law winners in them. There can only be one Power Law social network or search engine, but there can be a winning tech company in each sector and subsector of the physical economy.

- Examples. Companies like Anduril, Tesla, and SpaceX have shown founders that it’s possible to build enormous businesses by building hard things. (View Highlight)

- Or take Earth AI. What’s the Why Now for Earth AI? When Roman started the company in 2017, machine learning had finally gotten good enough that it was possible to analyze huge amounts of data to identify mineral targets just as the amount of new discoveries using traditional methods plummeted. While the company’s drilling rigs don’t rely on cutting-edge tech, the volume of targets Earth AI had to process made developing a faster, cheaper rig economical for the company in a way it wasn’t for traditional explorers. (View Highlight)

- Vertically integrating around those two technologies – AI and drilling rigs – make Earth AI possible. There’s a pattern. A bottleneck in a large, existing industry demands new solutions. Technological tools that have recently gotten good enough to address the bottleneck. And a strong team that’s able to build a vertically integrated solution to solve an important challenge. What’s true for Base and Earth AI is true for potential Techno-Industrials more broadly. (View Highlight)